Blog Detail

Indonesia's Healthcare Gold Rush: 2 Years Post-UU 17/2023 – Time to Bet Big?

By Inspiry Indonesia – Pioneers in hospital makeovers that blend heart and hustle to fuel explosive growth.

The Boom Beneath the Surface

Forget the hype — Indonesia’s healthcare sector is a buried treasure chest now bursting open for global investors.

Why are seasoned hospital tycoons worldwide taking bold bets here?

Because ignoring this boom could cost you — big.

Valued at USD 33 billion in 2023, the market is projected to reach USD 55.1 billion by 2030 — a strong 7.6% CAGR (Insights10).

The surge is driven by government commitment, regulatory liberalization, and a rapidly expanding middle class demanding better healthcare.

Enacted in August 2023, Law No. 17/2023 (UU 17/2023) slashed red tape, opened the door to 100% foreign ownership in hospitals, and strengthened universal coverage (ASEAN Briefing).

It’s an omnibus reform that turned sector inefficiencies into investor catnip.

7 Game-Changing Insights That Demand a Portfolio Rethink

1. Massive Market Scale: 278 Million People = Unmatched Demand Pipeline

Indonesia — the world’s 4th most populous nation — is still underpenetrated in healthcare.

Core Stats:

Hospital market: USD 33B (2023) → USD 55.1B (2030), CAGR 7.6% (Insights10).

Broader healthcare market: USD 22.4B (2025) → growing 6.76% annually (Map Resources Indonesia).

Middle class projected: 135 million by 2030 — preferring private care over public systems.

Investor Angle:

With JKN (National Health Insurance) covering 90%+ of the population — the world’s largest universal scheme — hospital revenue is predictable and steady (ASEAN Briefing).Why It Hooks:

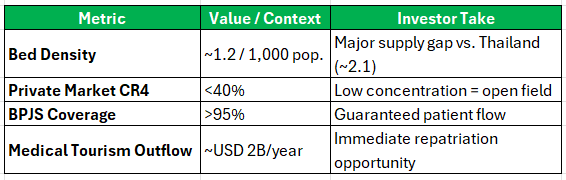

Only 1.2 beds per 1,000 people (vs global average 2.9) — meaning greenfield builds and upgrades are goldmines (TechSci Research).

2. UU 17/2023’s Foreign-Friendly Overhaul: 100% Ownership, Zero Bureaucratic Drag

This landmark law consolidated 11 outdated regulations into one cohesive system (Mondaq).

Key Reforms:

Allows 100% Foreign Direct Investment (FDI) in hospitals and specialized clinics.

Requires investment in Class A/B general hospitals with advanced tech (e.g., transplants, oncology).

Enables direct market entry into premium services and medical tourism (KR Asia).

Easing the Gaps:

Addresses COVID-era weaknesses — infrastructure, workforce, accessibility — while simplifying FDI processes (AHP.id, Lexology).The ROI Hook:

Indonesia once lost USD 1+ billion/year to outbound medical tourism (Trade.gov). Now, that flow can stay domestic.The Nuance:

Success depends on mastering Risk-Based Business Licensing (OSS RBA) — smart execution turns legal reform into ROI.

3. Government Backing: IDR 197.8 Trillion War Chest = Policy Stability

The 2025 health budget: IDR 197.8 trillion (~USD 12.7B) — up 10% YoY (Monroe Consulting).

Key Drivers:

JKN’s expansion → 90%+ population coverage (WHO).

Performance-based budgeting rewarding efficient hospitals (Schinder Law Firm).

Investor Angle:

Policy continuity under the Prabowo administration ensures low political risk. FDI in health up 15% post-2023 (State.gov).

4. Infrastructure Gaps = Prime Expansion Plays

Indonesia’s 2,800 hospitals serve 278 million people (Statista).

The scarcity isn’t just beds — it’s specialized quality.

High-Profit Niches:

Oncology: Radiotherapy & molecular diagnostics.

Cardiology: Advanced cath labs, cardiac surgery.

Neuroscience: Stroke & spine centers.

Mother & Child: High-trust, high-cash segment.

Digital Gold Rush:

Connected healthcare to soar from USD 0.88B (2025) to USD 3.06B (2030) at 28.18% CAGR (Mordor Intelligence).

UU 17/2023 mandates tech integration — a green light for AI diagnostics & telehealth (InvestinAsia).ROI Insight:

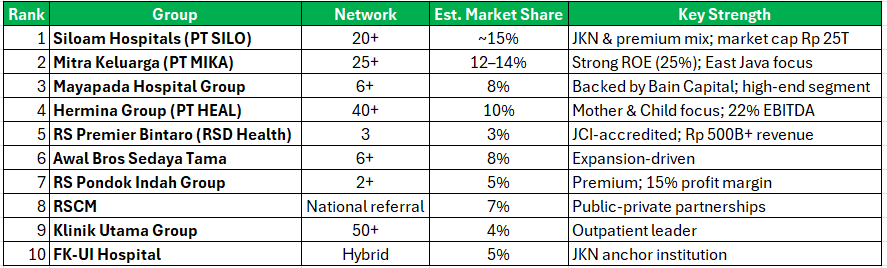

Urbanization (56% by 2025) and greenfield projects in Java/Sumatra yield 15–20% ROI (Map Resources Indonesia).5. Market Leaders: Top 10 Hospital Players (2025 Outlook)

The sector is fragmented but consolidating — top private chains control ~40% of private beds (Disfold, 2025).

Sector Averages (2025):

Market Cap: Rp 298.3T

Revenue: Rp 168.7T

P/E: 18.4x | ROE: 20%+ | Debt/Equity: 0.5x

Investor Hook:

Consolidation and M&A plays at 10–15x EBITDA — fertile ground for partnerships and joint ventures.6. Innovative Models: From KSO to Digital – Low-Risk, High-Yield

Indonesia’s market welcomes flexibility — from KSO (Operational Partnerships) to leasing schemes.

Hot Sectors:

Biotech FDI >USD 2B (Asian Insiders)

Healthtech (EHR/Telehealth) projected at USD 2B+ by 2030 (Ken Research)

Tax perks for pharma & digital health (InvestinAsia)

Investor Hook:

28% CAGR in connected health = scalable, tech-first investments with 20%+ margins (Mordor Intelligence).

7. ESG & Tech: De-Risking the Future

The post-pandemic playbook is clear — sustainability + technology = resilience.

Digital Efficiency:

EHR systems, teleconsultation, and AI diagnostics are must-haves to manage JKN volume and premium patient quality.Safeguards:

UU 17/2023 enhances IP protection and financial stability under JKN, cutting default risk (Insights10).Social ROI:

ESG-driven hospitals not only earn impact premiums but can boost IRR by up to 15% through sustainable builds.

Key Sector Metrics

The Dawn of a Healthier Horizon — Your Move, Investor

Two years into UU 17/2023, Indonesia isn’t just rebuilding healthcare — it’s reinventing it.

From FDI floodgates to trillion-rupiah budgets, the momentum is unstoppable.At PT Inspiry Indonesia Konsultan, we don’t just advise — we lead transformation in regulation, HR, reputation, and operations.

What’s your play?

Which of these 7 hooks resonates with your global strategy — FDI ease, consolidation plays, or digital upside?Let’s talk.

📩 international@inspiry.asia

📱 WhatsApp: +62 877 6777 1778

🌐 inspiryconsultant.com/id/inspiry-advisory

🔗 LinkedIn | IG | Facebook: Inspiry Indonesia#IndonesiaHealthcareInvestment #FDI #HospitalInvestment #HealthcareAsia #HealthTech #MedicalTourism #JKN #InspiryIndonesia #EmergingMarkets #GrowthPartnerHealthcare

Footnotes:

Market projections: Insights10 & TechSci Research (Indonesia Hospital Market 2023–2030).

FDI data: BKPM post-Omnibus implementation.

Connected health: Mordor Intelligence (2024).

Legal analysis: ASEAN Briefing, Mondaq, Lexology.

Budget & JKN: Monroe Consulting, WHO.

Top players: Simply Wall St, Disfold, InvestinAsia.

Healthtech & partnerships: Ken Research, Mordor Intelligence.